The Big Tax Bill – How Beautiful Is It?

- Danielle Seurkamp, CFP®

- Jul 25

- 6 min read

While its beauty is debatable, there is no denying that the One Big Beautiful Bill Act (OBBBA) is big. With impacts to everything from tax rates, deductions, clean energy, and saving for the next generation, its impact is vast. Let’s discuss the provisions most likely to impact your tax return in the years ahead.

Extensions of the Tax Cuts and Jobs Act (TCJA)

Permanent: Tax Brackets and Tax Rates

Tax rates will remain between 10% and 37% with little change to the tax brackets. Absent a tax bill, rates would have gone up to their pre-2017 levels.

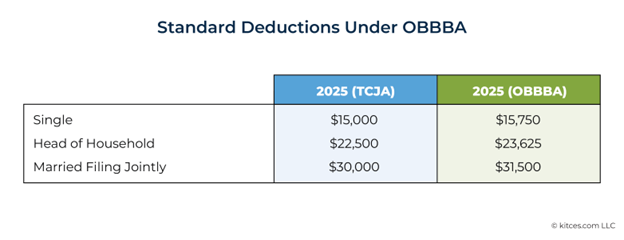

Permanent: Standard Deduction

Since 2017, far fewer taxpayers have itemized their deductions because they do not exceed the standard deduction. This is primarily because the standard deduction was significantly increased in the TCJA. The OBBBA makes the higher standard deductions permanent and slightly higher than those in the TCJA. Those over 65 also get an additional $1,600 to $2,000 on top of the figures below.

Permanent: Qualified Business Income Deduction, Section 199A

Sole proprietors, partnerships, and S corporations have been able to deduct up to 20% of their business income since the TCJA. This deduction is now permanent and will phase out at higher income levels. Singles with taxable income under $272,300 and married couples with income under $544,600 will be eligible for some portion of this deduction.

Permanent: Increased Child Tax Credit

The Child Tax Credit, available for those with kids under age 17, will remain higher, partially refundable, and will be increased annually by the rate of inflation. To get the full deduction, overall income must fall below $200,000 for singles or $400,000 for married couples.

Permanent: Higher Exemptions from the Alternative Minimum Tax

Higher exemption amounts (compared to before the TCJA) will continue, making far fewer people subject to the Alternative Minimum Tax.

Permanent: Higher Estate Tax Exemption

Taxpayers with estates under $15M per person, adjusted annually for inflation, will not be subject to federal estate tax. This prevented a reversion to a lower estate tax exemption that was in place before TCJA.

Permanent changes to tax law are not scheduled to sunset. They can still be altered with future tax legislation.

Repeals from the Inflation Reduction Act

Permanent: End of Several Clean Energy Credits

Credits for purchasing electric vehicles will end after September 30, 2025. The credit for installing electric vehicle charging equipment in your home will be available only for equipment placed in service by June 30, 2026.

Credits for energy-efficient home improvements like doors, windows, insulation and heating will be unavailable for equipment placed in service after 2025.

Credits for 30% of the cost of solar, wind, geothermal and fuel cell equipment will be unavailable for purchases made after 2025.

New Rules Under OBBBA

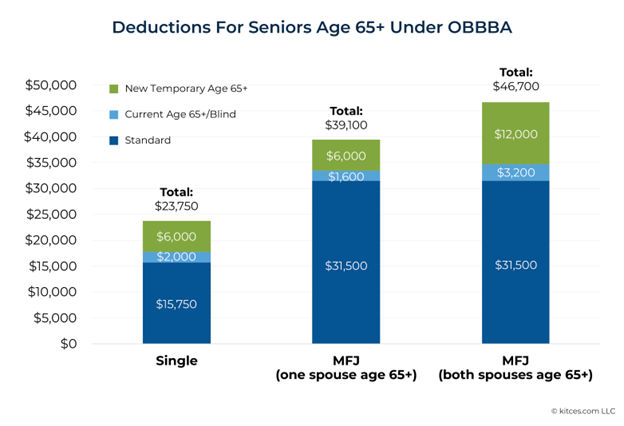

2025 to 2028: Temporary Deduction for Taxpayers over 65

For tax years 2025 through 2028, a new $6,000 (per person) deduction is available for those over 65. It is available whether you itemize deductions or not, and if your income falls below the threshold of $175,000 for singles and $250,000 for married couples, you will receive at least a portion of this deduction. Income must be below $75,000 and $150,000, respectively, to get the maximum deduction of $6,000.

While there have been claims that OBBBA eliminates taxes on Social Security income, taxes on Social Security income have not changed. This additional deduction will reduce seniors’ taxable income, but it doesn’t specifically target the tax on Social Security. The deduction will apply against any income on the tax return.

2025 to 2028: Temporary Deductions for Tip Income and Overtime Pay

There is a new deduction of up to $25,000 of tips earned in professions that customarily receive voluntary tip income. To get the full deduction, overall income must fall below $150,000 for singles or $300,000 for married couples. Those who earn tips in a Specified Service or Trade Business (SSTB), a classification for certain types of businesses like attorneys, financial planners, musicians, and entertainers, won’t be eligible for this deduction even if part of their income is derived from tips.

There is also a new deduction of up to $25,000 of overtime income. To get the full deduction, overall income must fall below $150,000 for singles or $300,000 for married couples. Only the overtime component of pay, or the amount that exceeds your normal pay rate, will qualify for the deduction. For example, if your base rate is $15 per hour and you earn $25 per hour for overtime, the $10 per hour extra is deductible.

2025 to 2028: Temporary Deduction for Auto Loan Interest

Loan interest of up to $10,000 a year for auto loans taken after 2024 will be deductible even if you don’t itemize. To get the full deduction, overall income must fall below $100,000 for singles or $200,000 for married couples. The loans must be for new cars that are used personally (not for business), weigh less than 14,000 pounds, and are assembled in the US.

Refinanced auto loans that don’t increase the overall loan balance can also qualify for the interest deduction.

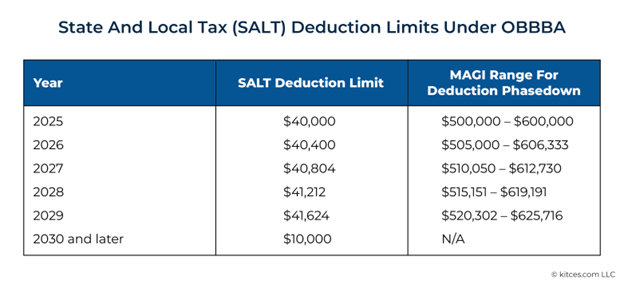

2025 to 2029: Temporary Increase to the State and Local Tax (SALT) Deduction

While fewer taxpayers are itemizing deductions, those who do will now operate under new rules.

One immediate change is an increase to the total allowable deduction for income, real estate, and personal property taxes paid to local governments. The deduction cap has been $10,000 since 2017 and will increase to $40,000 for tax years 2025 through 2029. This particularly helps those who pay high income taxes to their states, though the deduction will be limited for taxpayers whose income exceeds $500,000.

Permanent starting in 2026: Changes to Charitable Deductions

Note that charitable gifts are an itemized deduction, meaning only those who itemize rather than take the standard deduction receive a current-year write-off for their charitable giving. Since the standard deduction has been higher, fewer people have itemized or gotten a deduction for their gifts.

The OBBBA includes a new deduction starting in 2026 for charitable gifts of up to $1,000 for singles and $2,000 for married couples. It is available even if you don’t itemize. These gifts must be made in cash; donations of household goods or stocks will not qualify. Gifts cannot be made to donor-advised funds.

For taxpayers who do itemize, charitable deductions must now exceed .5% of adjusted gross income (AGI) to count. If your AGI is $100,000, that means the first $500 of charitable deductions will be ignored, and only gifts exceeding $500 will go on the tax return as a deduction.

Permanent: No More Miscellaneous Itemized Deductions; New Educator Expense Deduction

Miscellaneous itemized deductions have been gone since 2017 and aren’t coming back.

Starting in 2026, educators can now claim an itemized deduction for their out-of-pocket expenses. Unlike the current educator expense deduction, which is limited to $300, this deduction has no dollar limit. It does, however, require teachers to itemize if they want to claim the deduction, which means many teachers won’t benefit.

Permanent: New Expenses Can Be Paid with 529 Accounts

For several years, 529 plans have been approved for funding up to $10,000 a year of certain K-12 expenses. OBBBA increases the amount to $20,000 a year and adds to the list of qualified expenses to include things like books, online education, tutoring, exams like AP tests, and occupational, behavioral, physical, and speech therapy.

529 plans can also now be used toward qualified credential programs and continuing education to maintain them.

“Trump Accounts”

More details will become available on these accounts over time, but for now, we know there will be a new type of tax-deferred account available for minors. Contributions of up to $5,000 a year can be made for kids under 18, and while contributions won’t be tax-deductible, accounts will grow tax-deferred.

Employer can contribute up to $2,500 of the $5,000 limit. Governments and charities can also contribute in addition to the $5,000 max. A pilot program is set to offer children born between 2025 and 2027 a $1,000 contribution from the US government, though details have not been released yet on establishing these accounts or claiming these funds.

Conclusion

While this doesn’t cover every aspect of OBBBA and certainly doesn’t address the financial impact on those whose benefits may be lost to pay for these programs, it does cover the aspects of the bill that are likely to have the widest impact.

As a taxpayer navigating these new rules, it is critical to note when the various laws take effect and to parse the reality of the new laws from how they have been described publicly. Most notably, taxes have not been eliminated for those with Social Security, tips, or overtime income. Deductions for these constituents will reduce their tax liabilities over the next few years, before reverting to the prior rules.

With several new deductions that are limited based on overall income, the need for careful income and tax planning will be more important than ever. That said, the OBBBA has prevented most Americans from an impending tax increase and is likely to reduce taxes for many families, at least temporarily.

Comments